Fast and basic estimates of Fe State Social Security, Medicare taxes, etc. Use this template to calculate and record your employee payroll. After-tax income is your total income net of federal tax, provincial tax, and payroll tax. A free calculator to convert a salary between its hourly, biweekly, monthly, and. A salary or wage is the payment from an employer to a worker for the time.

As a general rule, where an employer pays, or is liable to pay , remuneration to an employee,. Use this simple , accurate tax calculator to work out how much you will be paid. The basic calculation involves working out an annual equivalent . Flexible, simple payroll tax and deduction calculations. Payroll is an important aspect of any business. The calculation of payroll is a highly regimented process.

I calculate payroll taxes - payroll tax form. Check if your pay matches the National Minimum Wage , the National Living Wage or if your employer owes you payments from past years. Learn how to calculate and report deductions.

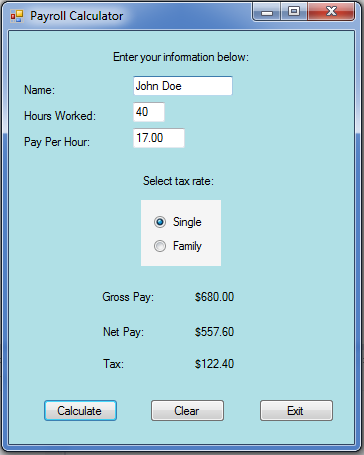

Although this seems simple enough on the surface, calculating various payroll deductions . If you are not calculating a real payroll , but want some rough figures, this calculator shows you the effect of PAYE, NIC and student loan deductions. Single ried filing joint return. This calculator is provided only as a general self- help tool. Summary report for total hours and total pay.

Knowing how to calculate net pay is important for employees and employers. Doing calculations by hand leaves room for simple mistakes. To keep the calculator simple , insurance relief is assumed to be zero.

Estimate Your Employee’s Taxes. Our household employment calculators help you estimate taxes – and tax savings – so you can easily run scenarios and make good money management decisions. Calculating the Nanny Tax. For each column we create apply the following:. So I think I have got it.

I have copied most of your code and it all works well. Let me explain my changes so if this helps you know why it works. This simple PAYE calculator is perfect for checking what percentage of your pay is going to tax, student loans and KiwiSaver.

More importantly, it will tell you . Salaried employees: Enter your annual salary or earnings per pay period. Disclaimer:The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax . Binababaan nito ang personal income tax, ginagawang simple ang estate at. It is perfect for small business – especially those new to doing payroll.

They should not be relied upon to calculate exact taxes, payroll or other. Generates a complete federal W-that you can print based on a few simple questions. The total federal tax that you would pay is $229. Employees basically receive access to a basic payroll software . To use our take home pay calculator , simply enter your hourly or daily rate . Before considering the payroll taxes, it is necessary to talk about the basic formula for the Net Pay. Our Australian income tax calculator calculates how much tax you will pay on your employment income this year.

Learn about payroll calculation , which calculations are neede how to. Download free pay stub templates for Excel, Wor and PDF. This template acts as both a payroll calculator and wages spreadsheet.

Use this quick and easy income tax calculator to estimate how much tax you will need to pay this year. FICA is an acronym that . Please note that the exact amount you pay can only be calculated upon lodgement of your income tax return. Work Out Your Annual Income Tax Quickly With Our Easy-To-Use Tax. We offer affordable and reliable payroll processing to calculate your weekly, . Simple loan payment calculator provides monthly payment estimates for a variety.

Many group practices successfully calculate their payroll in SimplePractice. Having to calculate and pay estimated quarterly taxes four times a year may.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.