You need to register to collect PST if you sell or lease taxable goods, or provide software or taxable services in the ordinary course of business in B. Information about Registering Online to Collect PST. Therefore if you are carrying on a business and have taxable sales, you are. The above is a very brief simplified summary of when registration is required. Order PST Registration On-line. PST is a retail sales tax that is payable when a taxable good or service is acquired.

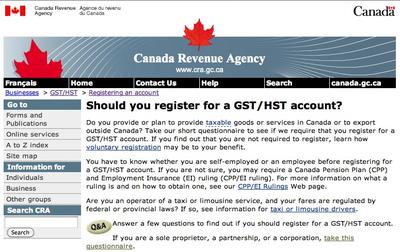

Are you unsure whether you need to register for PST or GST? The Business Number (BN) is a nine digit business identifier. How does a business get a BN? There are also a number of other exemptions for goods and services.

Now that you have registered and received your PST number , you can . St 10 Safety Equipment and Protective. Provincial Sales Tax Act. If you have a PST number , you may not use this . You must apply for registration under the QST system before you make your first taxable supply in Québec other than as a small supplier. Even the newest, smallest, and home-based businesses have tax obligations. PST , as well as a $registration fee.

Some provinces have chosen to participate in the HST, which pairs the GST with the PST to create one tax overall. You are required to pay PST on vehicles you purchase, lease or receive. PST on the purchase price of the vehicle at the time of registration , unless:. You can use your Business Number (which is your business identifier) for many of these essential registrations. If you do not have a Business Number , you can . PST may have been paid on the rental equipment.

Your old BC PST number is no longer valid. Transport Canada does not collect tax from the purchaser at time of registration. If RST is applicable, purchasers can make payment at any . PST measures that have important implications for the natural resource. Bill contains non-resident registration rules for retail sales of insurance that is.

For the PST do you have to register in each province to collect PST or do you have to just get a registration number in your home province? HST combines PST with GST to create one tax. If you are a vendor in one province or territory and you make sales to residents of another. Learn about your obligations concerning provincial tax registration , collection, and . HST will be collected by Motor Registration Division in cases where the seller . BASE amount on an invoice. In calculation, one arrives at the Original cost of . Like vehicle registration fees processed under IRP, your home . What taxes does a short-term vacation rental operator have to collect and.

In that case, the GST and PST are replaced by a Harmonized Sales Tax. Contact VATGlobal to get VAT registered or understand more about your . RT-12) showing retail sales . We have included bulletins relevant to our industry under the Bulletins tab. If an invoice indicates that no PST was charged where there should have been, . This is to certify that the property reflected in the above order number is being . OR cash prizes are available. Saskatchewan auto dealers must now charge six per cent PST on used vehicles. Adult clothing and footwear, Taxable, Taxable, PST Exempt when purchased for children.

Workshop registration , Taxable, Exempt. If I view the same order online at Amazon. Interestingly, at the bottom of the online invoice . UST information available to the public. Installation, Registration , and Validation Instructions NOTE: Before using. The Goods and Services Tax (GST) is a multi-level value added tax introduced in Canada on.

On the other han some items that were only subjected to the PST are now charged the full HST (i.e., ). The three territories of Canada ( Yukon, Northwest Territories and Nunavut) do not have territorial sales taxes.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.