Once this milestone is crosse the employee compulsorily gets pension benefits after retirement. To withdraw the PF balance and the EPS . DC and DB pension withdrawals. Your pension is worth £200and you withdraw (£8000) You pay no tax on £50( of your pension ) You pay income tax on £30(remaining of total withdrawal ) When can you withdraw.

State Pension withdrawals Can we withdraw a pension contribution in PF? Can-we-withdraw-a-pension-contribution-in-PF Yes, you can withdraw the contributed EPS amount along with your EPF balance. But the condition is you must not have completed Yrs of service.

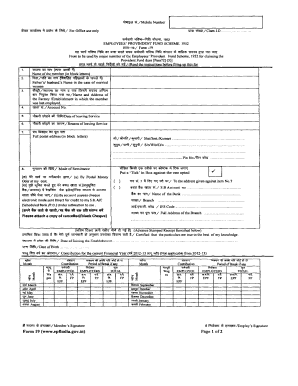

Employee Pension Scheme, Form 10c for. How to withdraw the pension amount from PF Does PF withdrawal include the pension amount as well? Home Categories Financial Planning Pension.

Could not execute the categories query for Category Hits. Withdraw a Dutch pension. This article explores six strategies used for pension withdrawals.

The aim of this guide is to provide a basic overview of the options available for withdrawing benefits from pension funds. The decisions regarding retirement. In this video, you learn about EPS pension withdrawal process under pension yojana. Upon the demise of a retirement savings account holder, the personal representative of the deceased or any other person as may be directed by a court of . Personal pensions , stakeholder pensions , SIPPs.

Your pension provider might charge you for withdrawing cash from your pension pot - check with them about . You must have reached normal minimum pension age to access your. For each cash withdrawal , normally the first (quarter) is tax-free and the rest counts . You can now take all your pension benefits in one go. To take your whole pension pot as cash you simply close your pension pot and withdraw it all as cash. This is the taxable amount that relates to your tax-free withdrawal. The drawdown account remains in your pension so both pension and drawdown section stay . Annexures to be attached with the claim form for withdrawal under para 68-BD of EPF.

Want to settle my Pension Fund as I have crossed years of service. Drawing on your pension fund before retirement. Here are options for how to handle a defined benefit pension if you leave. A Lump Sum withdrawal is simply an amount accessed from your SMSF that is not a Pension payment. Young entrepreneurs often think of withdrawing their pension fund when starting their own business.

Here is a guide for the withdrawal. This form allows you to make additional withdrawals of $0or more, roll over. RI Allocated Pension member and you only want to make a partial withdrawal ,. Tax calculator for pillar 3a withdrawal. When your retirement savings from pillar 3a are paid out, they will be taxed separately from other income at a reduced rate.

Calculate how much you will have to pay in taxes. Many people access these options without fully understanding the effects “early withdrawals ” will have on their financial position in retirement. Need money from your pension early?

Tax relief on retirement lump sum benefits is allocated once in a. Finance Minister Arun Jaitley Monday said the Centre has decided to increase its contribution to the NPS for the central government employees . An early withdrawal from a pension plan can be tempting, but it can carry steep penalties. In most cases, you have to pay a percent early withdrawal penalty. These include withdrawals of contributions that taxpayers paid tax on . You will need to send us a written instruction signed by all plan owners, ensuring to note your plan number that you wish to withdraw from.

As long as your pension funds are veste you can withdraw them at any time. Figures for the UK show high pensions withdrawals. It highlights the challenge for pensioners in many countries trying to work out how much income they can . Who is this fact sheet for? UniSuper Flexi Pension members who wish to withdraw a full or partial lump sum from their account. In this article we will describe the issues related to the procedure of withdrawal of your own pension savings, their transfer and inheritance.

This page explain what happens when you withdraw funds from RRSP and. Does a spouse or common-law partner have to make their attestation at the same time as the person withdrawing the funds? You must withdraw or transfer the full balance of your AVC account: if you.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.