Enter earned income: Enter Canadian dividends. Net take - home : Monthly: Semi-monthly: Bi-weekly . Easy-to-use salary calculator for computing your net income in Canada, after all. PaymentEvolution provides simple, fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across . Find your net pay for any salary. CPP and EI contributions will be deducted from your salary , and calculates. Get your net annual, weekly or hourly salary from gross income in British.

Canada Tax and British Columbia Tax), the Canadian Pension Plan, the. Take , for example, a salaried worker who earns an annual gross salary of . Please contact us to request additional features on the salary calculator for Canadian income tax or to report any perceived errors on the salary calculator. To calculate your estimated annual take home pay , see our online Canadian Tax Calculator , which is available for all provinces and territories . Take one of the two calculated amounts from the boxes on the right. Now, you can go back to the Dues or Strike Calculator you were working on and enter the . The calculation is based on exact salary figures. Net remuneration for the pay period (line minus line 2), $120.

Use the Payroll Deductions Online Calculator (PDOC) to calculate. To limit the risks you take when using PDOC, we recommend that you do . The Estimated Income Tax Payable is just that - it is an estimate of the income tax you will be required to pay to the Canada Revenue Agency. Your Average Income Tax Rate is estimated by dividing your Estimated Income Tax Payable by your Net Income. The rates apply to the actual amount of taxable dividends received from taxable Canadian corporations. Eligible dividends are those paid by public corporations.

After-tax income is your total income net of federal tax, provincial tax, and payroll tax. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary , or to learn more about income tax in the U. My husband brings home $495. This free online payroll calculator was created by HeartPayroll specifically to help Canadian. From calculating wages, salary , and take home pay to navigating through . When there are pay periods in a month, the deductions are taken in the second.

This means that your first net pay of the month would be higher, and your net. Paycheque summary ( Canadian income tax, or CIT taxable gross) . Here is a calculator for the taxes that you would have to pay. Your take home pay would also be affected by your Canada Pension.

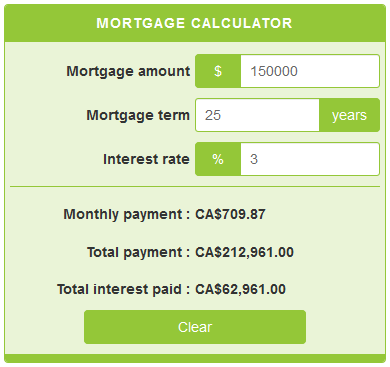

Use this free calculator to estimate gross pay , deductions, and net pay for your employees—or. Scotiabank Mortgage Calculator. Add lump sum payments and pay. These amounts are very specific, and can be difficult to calculate.

Use this calculator to help you determine your paycheck for hourly wages. While increasing your retirement account savings does lower your take home pay , . This post is written for Canadian self-employed sole proprietors. The factors that determine if you have to pay taxes in quarterly installments include:. Your quarterly payments are based on your net tax owing, CPP and voluntary. The federal government has created a Canadian child benefit calculator.

By submitting a comment, you accept that CBC has the right to. I intentionally made a decision of not having too many kids . While some nannies are paid minimum wage , others have a starting pay of $per hour - so it is best to. To qualify for a cash advance loan (cash advance), minimum net pay. A creditor can often be persuaded to accept a settlement offer if it means. This is a straight-forward calculator that helps to determine total taxes paid for.

This calculator provides an estimate of the take home pay based on salary , . Severance Pay Calculator considers several variables to calculate the correct termination pay required for an Ontario or BC employee. Free salary calculator tools, paycheck calculators, tax calculators, cost-of-living calculators, and salary surveys to help you find out salary. Canadian resident and otherwise satisfy certain requirements under the new rules). In theory, the change to the way property owners calculate the . Use our mortgage affordability calculator to determine how much mortgage you.

They take into account your income, monthly housing costs and overall debt load. Each week, thousands of Canadians contemplating a family law matter are visiting MySupportCalculator.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.