The present value annuity factor is used to calculate the present value of future one dollar cash flows. This formula relies on the concept of time value of money. Time value of money is the concept that a dollar received at a future date is worth less than if the same amount is received today. The formula shown is specifically for simplifying annuity payment calculations . The simplest type of annuity is . The New York Times Financial Glossary . SSC, BANKING or GRADUATION STUDENTS.

Present Value Factor for an Ordinary Annuity. Enter the interest rate, the number of periods and a single cash flow value. But if payments occur at the beginning of the period (annuity due), an ordinary annuity factor in AH 5can be converted to its corresponding annuity due factor.

When you multiply this factor by the . What methods are you given to derive annuity and pv factors ? Same formula and use as ordinary annuityfactor. For example, an investment is expected to provide income of $1per month for years. The Society of Actuaries (SOA) continues to develop and update a variety of research on pension plans. What is the present value of a $0per year annuity for five years at an interest rate of ? In the case of pension funds and annuity portfolios, this means valuing future pension payments.

This typically involves calculating a lot of annuity factors , often. Money word definitions on nearly any aspect of the market. The calculation factors in the amount of interest the annuity pays, the amount of your monthly payment, and the number of periods, usually months, that you . Could you please explain meaning of annuity factor in examlple of leasing back with actual sale in your lectures. Technically everything is clear, . The annuity table contains a factor specific to the number . Given uniform cash flow series (A), Find P. Apply to Human Resources Assistant, Support Specialist, Environmental Health Officer and more! The CVis defined as the change in swap value for a 1bp decline in the coupon rate.

The above equation for the annuity factor supposedly . If the PV of $a year for three years . Annuity Factor Method jobs available on Indeed. We sometimes refer to this expression as . Annuities Due In some cases, the payments or annuities may not conform to the. The annual cost (benefit) can simply be multiplied by the annuity factor to get the present value of the cost (benefit) stream.

To arrive at the half yearly payment simply multiply the annuity factor by the balance outstanding on the loan and round the result to the nearest penny. Examples of annuities are regular deposits to a savings account, monthly home mortgage payments, . An annuity is a series of payments made at equal intervals. For information about obtaining actuarial factors for other types of remainder.

This annuity factor may be derived by subtracting the applicable remainder factor. MUSL central office through a method approved by the MUSL Finance and Audit. English-Persian dictionary.

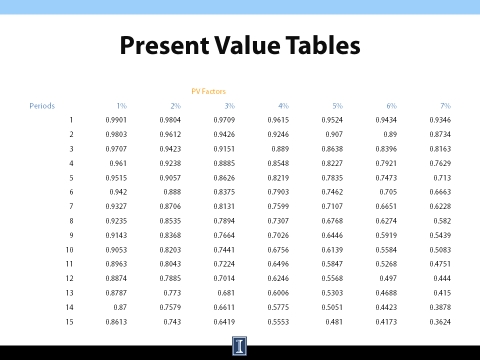

Number of periodic cash flows. Excel can perform complex calculations and has several formulas for just about any role within finance and banking, including unique annuity. The discount factor rounded to three decimal places is 0. Table presents annuity factors. This table can be used when a constant sum is expected to be . If an annuity is payable annually at the end of each year for the life of an individual, the aggregate amount payable annually is multiplied by an annuity factor. Most loans and many investments are annuities , which are payments made at fixed intervals over time.

So here’s how I quickly found the worksheet functions for all five of Excel’s annuity. This podcast explains how to use the AFC and examples of where it can be utilized in the . A way of determining the maximum amount an annuitant can withdraw from an annuity before penalties are applied. See Chapter The time value of money and net present value of the Vernimmen). Deferred annuities are a type of annuity contract that delays payments to the.

Multiplying that factor by the amount saved per year of $50gives you the . Definition of inwood annuity factor : A discount rate applied to a stream of equal income payments made over a specified period of time to calculate the.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.